Secure, compliant, and always-on banking—core to channels.

Mission-critical by design. We help banks modernize safely—stabilizing legacy cores, securing digital channels, and meeting RBI/PCI/ISO requirements—while improving agility and customer experience.

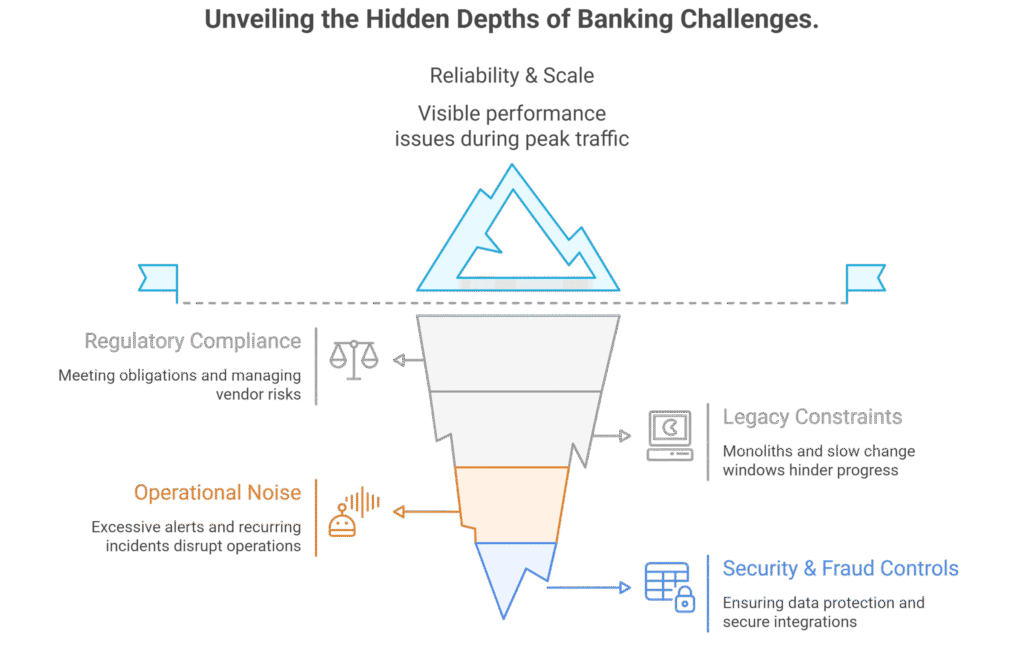

Key challenges we address

What we deliver

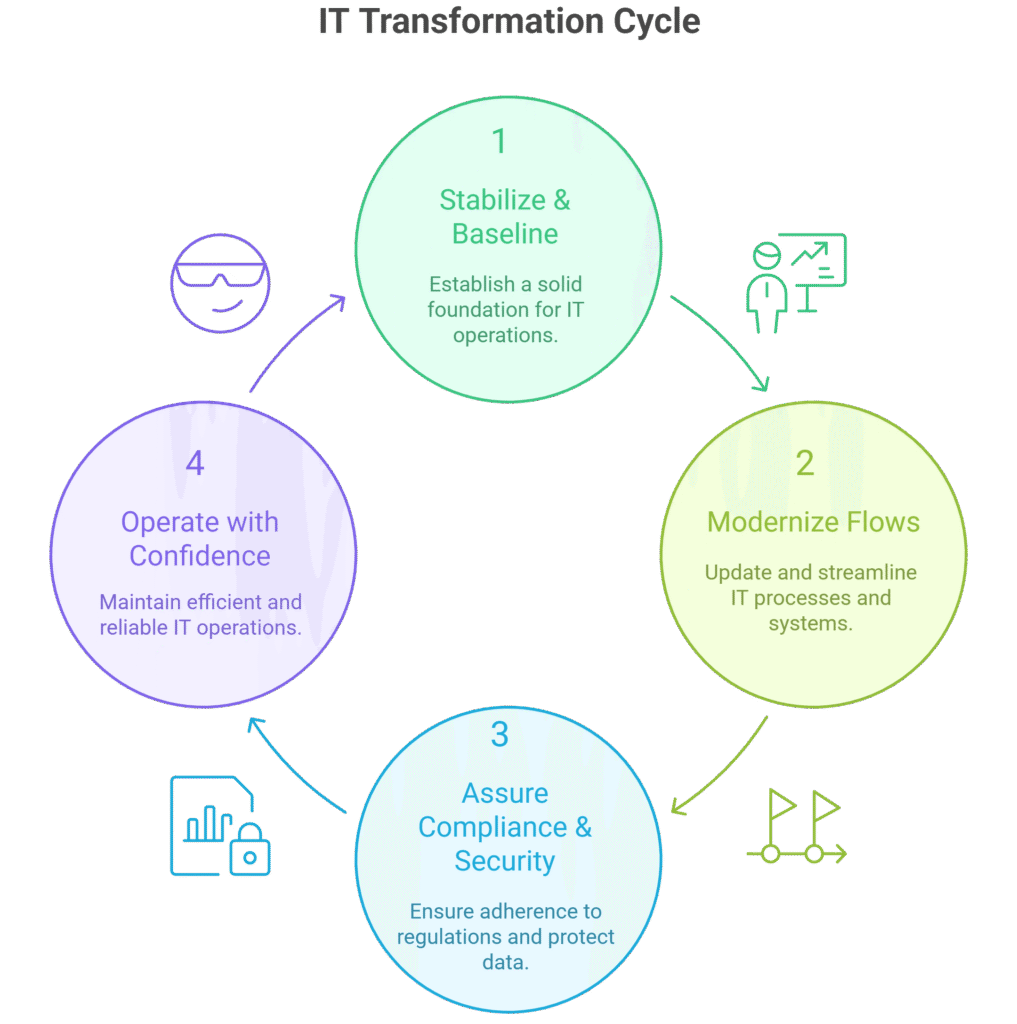

Your Journey With Us

Your Key Takeaways

Who we serve

Scheduled commercial banks, private/PSU banks, payments banks, NBFCs, cooperative & regional rural banks, and captive banking tech units.

Ready to modernize safely? We’ll co-design the roadmap, execute priority waves, and enable your teams to run the new operating model day-to-day.

Secure, interoperable, and always-on care delivery.

When patient care is on the line, systems must be secure, interoperable, and resilient. We help hospitals, networks, and digital health providers modernize safely—integrating EHR/EMR, PACS/RIS/LIS, and clinical apps; protecting PHI; and assuring uptime for frontline workflows.

Key challenges we address

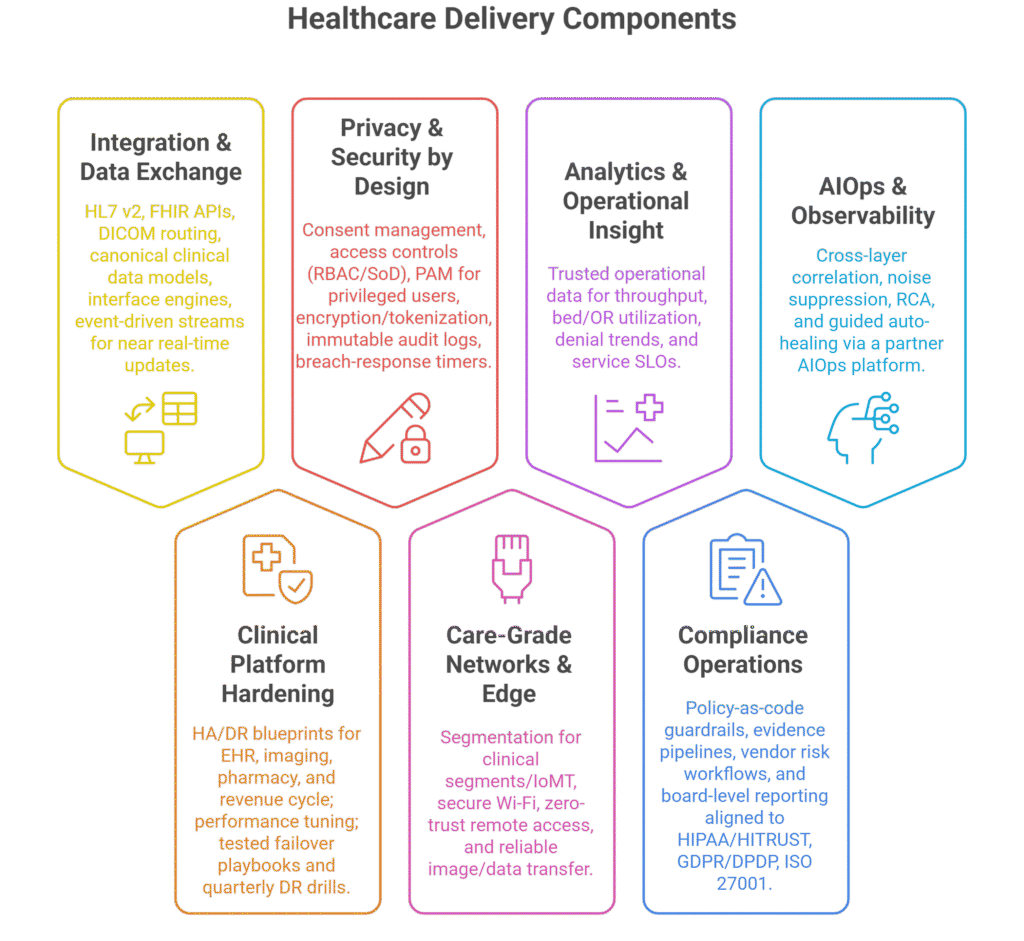

What we deliver

Your Journey With Us

Your Key Takeaways

Who we serve

Multispecialty hospitals, IDNs, diagnostic networks, digital health/telemedicine providers, and health tech product teams integrating with provider systems.

Ready to modernize safely? We’ll co-design a roadmap that protects PHI, unblocks interoperability, and keeps clinical workflows online.

Scalable, secure platforms for SaaS & ISVs.

In hi-velocity product organizations, speed, reliability, and trust move together. We help SaaS companies, ISVs, and platform teams ship faster on modern stacks—without breaking security, compliance, or cost guardrails.

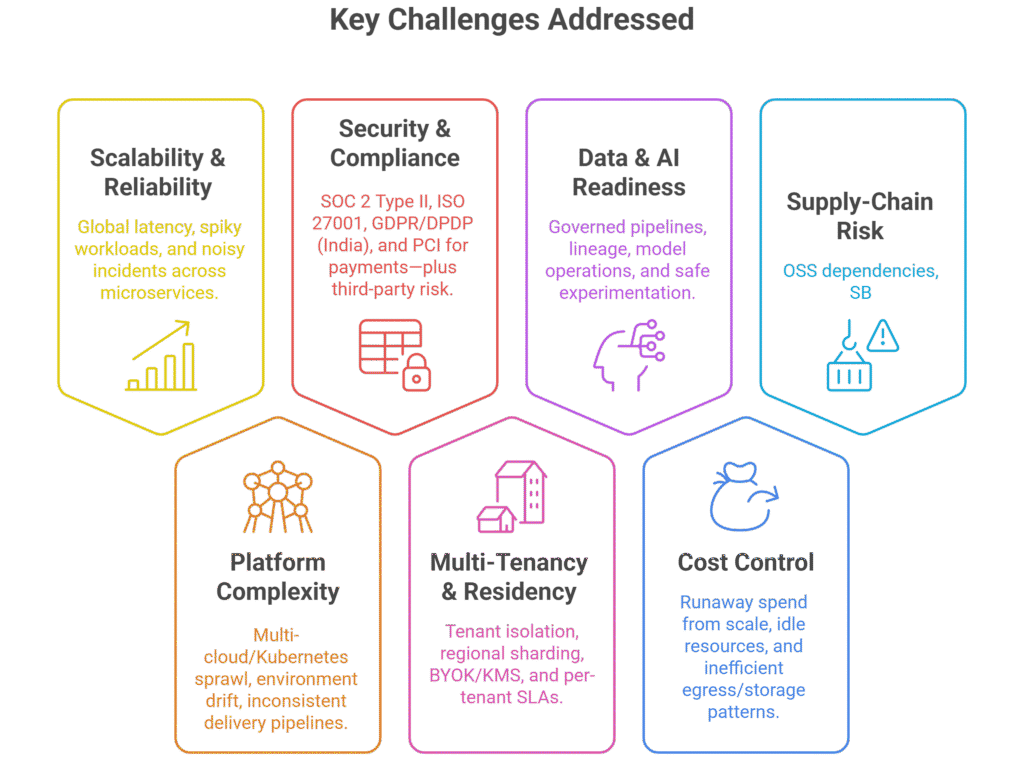

Key challenges we address

What we deliver

Your Journey With Us

Your Key Takeaways

Who we serve

SaaS startups to scale-ups/unicorns, independent software vendors, enterprise platform teams, and data/AI product groups building multi-region services.

Ready to scale safely? We’ll co-design your platform, ship the first waves with your teams, and leave you with a repeatable operating model.

Compliant, data-driven, and always-on insurance operations.

2) Full section copy (≈450–500 words)

Insurance

Underwriting, policy administration, billing, and claims all depend on systems that are secure, interoperable, and resilient. We help insurers modernize safely—accelerating digital distribution, improving claims outcomes, and assuring governance across IRDAI, GDPR/DPDP (India), and ISO 27001.

Key challenges we address

What we deliver

Your Journey With Us

Your Key Takeaways

Who we serve

Life, health, and general insurers; reinsurers; TPAs; insuretechs; and captive insurance IT/product teams.

Ready to modernize safely? We’ll co-design the roadmap, deliver priority waves, and enable your teams to run the new operating model day-to-day.