Client: Pan-African banking group (name withheld)

Scope: Core banking (Oracle FLEXCUBE), digital channels, middleware, and DC/DR across multiple African markets

Objective: Improve reliability, performance, and audit readiness across countries while enabling future cloud/hybrid choices.

Executive Summary

Work spanned core banking systems, data center and disaster recovery topology, and multi-country operations requiring high availability and data residency.

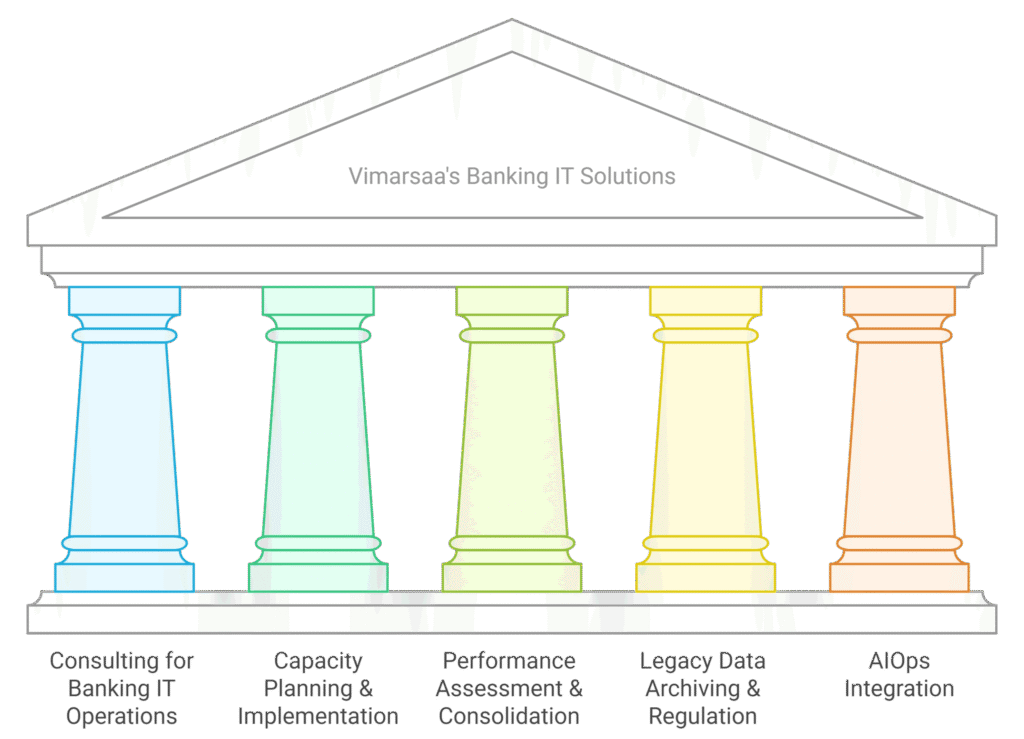

Through structured capacity planning and performance tuning, we stabilized peak-day loads across high-volume payments, card/ATM, mobile money, and batch windows.

Engagements delivered zero-downtime cutovers for core banking upgrades and migrations, with rehearsed rollbacks and blue/green deployment patterns.

Banking infrastructure performance optimization targeted DB/WebLogic/OHS stacks, connection pools, query/partition design, and JVM/I/O tuning.

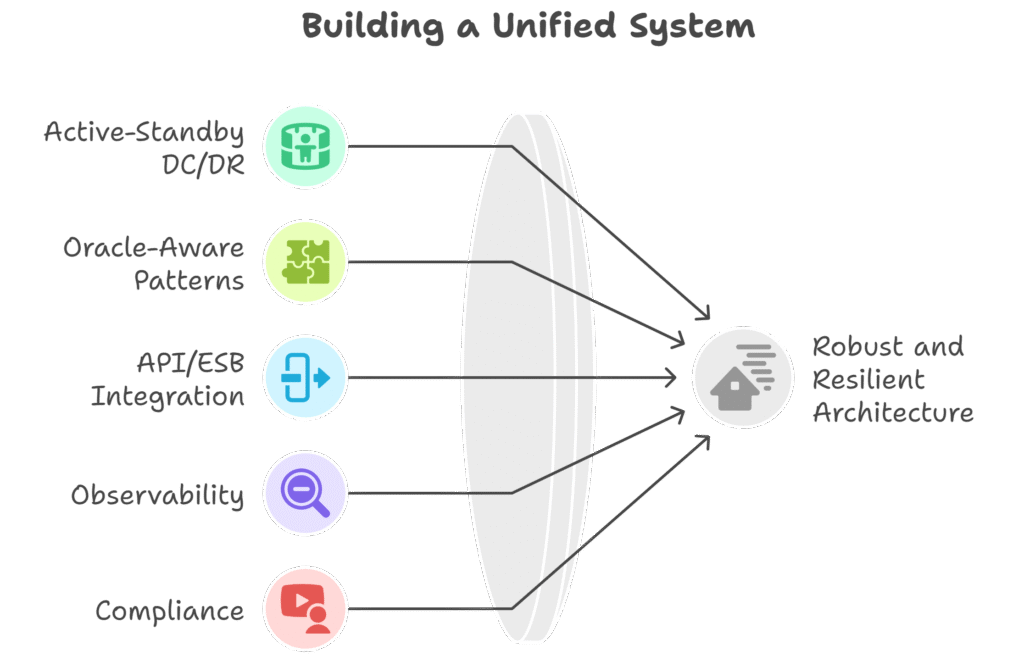

DR assurance was verified with failover drills, recovery runbooks, and RPO/RTO targets aligned to business services for sustained uptime.

API-led integration and event-driven patterns replaced brittle links, enabling secure partner connectivity and modern banking message flows.

Hybrid cloud and on-premises options were evaluated via landing zones, security baselines, and reversible pilots to de-risk adoption.

Compliance operations established audit-ready evidence mapped to regulatory obligations and internal policies, with clear owner accountability.

Standardized observability for banking infrastructure unified logs, metrics, and traces to cut mean time to detect across core, middleware, and channels.

Where appropriate, cross-layer correlation and guided auto-healing were enabled via a partner AIOps platform (delivered with QPH)—fully optional.

Operating models introduced SLOs, on-call health, and automation-first runbooks to reduce toil and MTTR.

Representative outcomes included four-nines availability, improved p95 latency at peak, and days—not weeks—for audit pack assembly (results vary by context).

These anonymized lessons form a repeatable banking infrastructure modernization playbook that Vimarsaa now applies in advisory, implementation, and integration roles.

Business Challenges

Strategic Deliverables, Tailored to Your Business

Our Approach

Architecture Highlights (conceptual)

Representative Outcomes

Deliverables Handed Over

Sizing & Capacity Workbook; HLD/LLD architectures; Cutover & Rollback Playbooks; DR Drill Reports; Performance Assessment Report; Compliance Evidence Workbook; Data-Archiving & Retention Policy; Operations Runbooks & SLO pack.

Partner note

Select observability & AIOps capabilities are delivered with our consulting solution partner, QuantlliPulseHUB Pvt. Ltd. (QPH). Vimarsaa provides advisory, integration, and operations enablement; platform IP and licensing remain with QPH.

Oracle and FLEXCUBE are trademarks of Oracle and/or its affiliates. Vimarsaa is not affiliated with or endorsed by Oracle.